The ACH Apr 26 Call options got called out even though it corrected steeply (> 6%) on option expiry day last Friday as it stayed above $26. Thats the beauty of "at-the-money" call options. I am left with STLD & GG and get to write options again into May. In fact, it would be the 3rd cycle for GG. i.e I have written call options twice before & this would be the 3rd time against the same batch of stocks bought in Mar. As for May's options play, I wrote the May 18 Call for STLD @ 0.7 & the May 40 Call for GG @ 1.15. I also bought back some ACH stocks at an average of 26.2 & sold the May 26 Call option @ 1.2.

The fundamental picture is strong for equities and the news from the 1Q reporting season has been very supportive so far. I continue to maintain a cautiously positive outlook of the market in the short to medium term.

Current Trades:

STLD: Bought stock at $17.80, Sold the May 21 Call for $0.7

ACH: Bought stock at $26.2, Sold the May 21 Call for $1.2

GG: Bought stock at $38, Sold the May 21 40 Call for $1.15

Blog Archive

- April (2)

- March (1)

- March (1)

- February (5)

- January (3)

- December (7)

- November (10)

- October (8)

- September (13)

- August (16)

- July (25)

- June (23)

- May (18)

- April (17)

- March (12)

- February (8)

- January (5)

- December (12)

- November (12)

- October (18)

- September (8)

- August (12)

- July (13)

- June (8)

- May (2)

- April (1)

- March (1)

- February (1)

- January (2)

- December (3)

Labels

- Financial Planning (5)

- Law Of Attraction (2)

- Options Writing (196)

- Strategy (7)

- The Week Ahead (7)

- Trading Income Meter (1)

- Warriors attitude (2)

Tuesday, April 20, 2010

Sunday, April 11, 2010

Options Writing Trade Update - Apr 12

This week is options aspiration week. Alcoa kicks off the Q1 earnings reporting cycle on Monday followed by Intel on Tuesday and JP Morgan, Google and Bank America later in the week. This will set the tone for the following few weeks about the economy.

If there are no major earning disaster, I am hoping that the long stocks will all be in the money & the April Calls be called out & hence, leaving me with zero positions. This provides the perfect opportunity to lock in some gains and then take a renew look at where the market is going next before taking on anymore new positions. Moving forward in the next couple of weeks, any declines would be regarded as healthy corrections & will present good covered call opportunity as my current medium to long term view is still cautiously bullish.

If there are no major earning disaster, I am hoping that the long stocks will all be in the money & the April Calls be called out & hence, leaving me with zero positions. This provides the perfect opportunity to lock in some gains and then take a renew look at where the market is going next before taking on anymore new positions. Moving forward in the next couple of weeks, any declines would be regarded as healthy corrections & will present good covered call opportunity as my current medium to long term view is still cautiously bullish.

Monday, March 29, 2010

Options Writing Trade Update - Mar

I took a break from writing for almost a year. Lets put it this way, I was involved in a project (extending my comfort zone) which was of higher priority & it totally consumed me. Now that the project has taken off, I have alittle more time to do this. In any case, the trading continues just minus the documentation.

For the last 12 months I have been capitalising on the market's sideways to cautious upward trend with covered call plays reaping profits(30%-40%) for all my clients (small funds). It appears that this trend may continue well into rest of 2010 but of course one should still exercise caution & care as with any strategy and minimise risk. Currently these are the positions I have:

STLD: Bought stock at $17.80, Sold the Apr 18 Call for $0.5

ACH: Bought stock at $26, Sold the Apr 26 Call for $1.0

GG: Bought stock at $38, Sold the Apr 40 Call for $0.95

By the way, I was caught by surprise about the announcement by ACH on their overall dismal performance for 2009 over the weekend. This has been factored into the share price & it appears that investors are looking beyond that & the recent Rio Tinto-Chalco deal + overall increase in Aluminium prices or some strong invisible force in the background lended some support to the stock. The following Monday, ACH rose by 1.51% at the close. I am watching this one closely.

For the last 12 months I have been capitalising on the market's sideways to cautious upward trend with covered call plays reaping profits(30%-40%) for all my clients (small funds). It appears that this trend may continue well into rest of 2010 but of course one should still exercise caution & care as with any strategy and minimise risk. Currently these are the positions I have:

STLD: Bought stock at $17.80, Sold the Apr 18 Call for $0.5

ACH: Bought stock at $26, Sold the Apr 26 Call for $1.0

GG: Bought stock at $38, Sold the Apr 40 Call for $0.95

By the way, I was caught by surprise about the announcement by ACH on their overall dismal performance for 2009 over the weekend. This has been factored into the share price & it appears that investors are looking beyond that & the recent Rio Tinto-Chalco deal + overall increase in Aluminium prices or some strong invisible force in the background lended some support to the stock. The following Monday, ACH rose by 1.51% at the close. I am watching this one closely.

Monday, March 16, 2009

Mar 17 Options Writing Trades Update

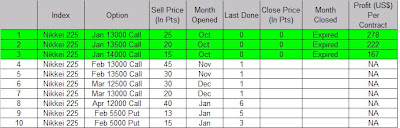

The Mar options expired last Thu. I wrote some N225 Jun 10000 & limited 9500 call options for 25 pts & 30 pts last week. Markets has rallied in the last 4-5 days & going against the Jun options. So we need to monitor the markets more regularly. On any retraction, it signals an opportunity to write some Apr Puts.

Tuesday, February 24, 2009

Feb 25 Options Writing Trades Update

Sunday, February 22, 2009

Feb 23 Options Writing Trades Update

I wrote limited positions on the N225 Mar 5500 puts for 18 pts today.

Wednesday, February 18, 2009

Feb 18 Options Writing Trades Update

I am looking at the Mar 5500 Puts and below. On volatilty, I will write limited positions.

Thursday, February 12, 2009

Feb 12 Options Writing Trades Update

I wrote the N225 May 10000 Call Options for 25 pts today. Overall market sentiments remains cautious. I am looking for opportunity to write some Mar's puts.

Wednesday, February 11, 2009

Feb 11 Options Writing Trades Update

Tuesday, January 27, 2009

Jan 28 Options Writing Trades Update

Market is sideways moving pretty much lately. The bottom line is the path of least resistance for this market is still down—and may be for quite awhile. If we think this earnings season is bad we’ve still got first quarter earnings to get through in April and they are likely to be a whole lot worse than what we are seeing right now. My mid term view till Jun remains the same, bearish to sideways and the trading strategy remains- Sell Calls.

Meanwhile, all eyes are on the US stimulus package to see how things will unfold. I am looking to sell some N225 May call options (11000 & above) & possibly some Mar puts from next week onwards on volatility.

Meanwhile, all eyes are on the US stimulus package to see how things will unfold. I am looking to sell some N225 May call options (11000 & above) & possibly some Mar puts from next week onwards on volatility.

Subscribe to:

Comments (Atom)