Market is sideways moving pretty much lately. The bottom line is the path of least resistance for this market is still down—and may be for quite awhile. If we think this earnings season is bad we’ve still got first quarter earnings to get through in April and they are likely to be a whole lot worse than what we are seeing right now. My mid term view till Jun remains the same, bearish to sideways and the trading strategy remains- Sell Calls.

Meanwhile, all eyes are on the US stimulus package to see how things will unfold. I am looking to sell some N225 May call options (11000 & above) & possibly some Mar puts from next week onwards on volatility.

Blog Archive

- April (2)

- March (1)

- March (1)

- February (5)

- January (3)

- December (7)

- November (10)

- October (8)

- September (13)

- August (16)

- July (25)

- June (23)

- May (18)

- April (17)

- March (12)

- February (8)

- January (5)

- December (12)

- November (12)

- October (18)

- September (8)

- August (12)

- July (13)

- June (8)

- May (2)

- April (1)

- March (1)

- February (1)

- January (2)

- December (3)

Labels

- Financial Planning (5)

- Law Of Attraction (2)

- Options Writing (196)

- Strategy (7)

- The Week Ahead (7)

- Trading Income Meter (1)

- Warriors attitude (2)

Tuesday, January 27, 2009

Wednesday, January 14, 2009

Jan 14 Options Writing Trades Update

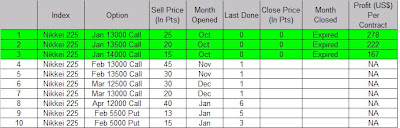

While the broad strokes are known, many factors remain unclear regarding how bad the economic situation will pan out for 2009. My mid term view (till June) about the market remains bearish to sideways trending. I will continue to sell calls into May & may dabble into a few near month Puts options where the situation permits. I wrote limited N225 Feb 5500 Put for 13 pts yesterday.

Wednesday, January 7, 2009

Jan 7 Options Writing Trades Update

Subscribe to:

Comments (Atom)