Blog Archive

- April (2)

- March (1)

- March (1)

- February (5)

- January (3)

- December (7)

- November (10)

- October (8)

- September (13)

- August (16)

- July (25)

- June (23)

- May (18)

- April (17)

- March (12)

- February (8)

- January (5)

- December (12)

- November (12)

- October (18)

- September (8)

- August (12)

- July (13)

- June (8)

- May (2)

- April (1)

- March (1)

- February (1)

- January (2)

- December (3)

Labels

- Financial Planning (5)

- Law Of Attraction (2)

- Options Writing (196)

- Strategy (7)

- The Week Ahead (7)

- Trading Income Meter (1)

- Warriors attitude (2)

Monday, March 31, 2008

Mar 31 Option Trades Update

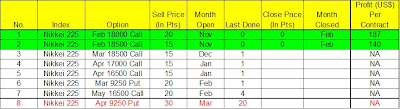

Japan's Nikkei benchmark slid 2.3 percent on Monday, finishing the fiscal year with its worst quarterly performance since 2001. In the short term, a slew of key Japanese and U.S. indicators are due out over the next few days, including the Bank of Japan's quarterly "tankan" survey of business sentiment on Tuesday. All of the indicators coming out this week appear likely to point to tough times ahead, so the market may be vulnerable. But then again, markets may already have factored these in. In any case, I am eyeing the N225 May 9000 & 9250 Puts to add to my positions.

Thursday, March 27, 2008

Mar 27 Option Trades Update

Sunday, March 23, 2008

Mar 24 Option Trades Update

Friday, March 21, 2008

Mar 21 Option Trades Update

Japan's Nikkei share average rose 1.8 percent on Friday, climbing for a third straight day thanks after a rise on Wall Street. I wrote additional N225 Jun 15500 Call Options for 25 pts. Meanwhile, premiums of various existing write options positions are decaying in my favour in today's volatile markets.

Tuesday, March 18, 2008

Mar 19 Option Trades Update

Mar 18 Option Trades Update

Japanese stocks rose on Tuesday along with other Asian bourses after Monday's selldown." The Fed is widely expected to deliver one of the steepest interest rate cuts since 1982 after the European market close on Tuesday as it struggles to shoreup the U.S. economy against further damage from the turmoil in the credit markets. I wrote limited N225 Apr 9250 Put options for 45-55 pts.

Monday, March 17, 2008

Mar 17 Option Trades Update

Global stocks fell sharply and the dollar tumbled on Monday as a fire sale of Bear Stearns and an emergency Federal Reserve cut of a key lending rate sparked fears that a worldwide credit crisis will claim more casualties. The benchmark Nikkei plunged 3.7%. All the Mar's N225 options expired worthless. The April 9250 is last done at 2x(60pts) the premiums sold for.

Wednesday, March 12, 2008

Mar 12 Option Trades Update

Asian markets rose Wed, after Wall Street rally due to Fed's liquidity injection. So did the Japan's benchmark Nikkei. I was looking at the N225 May 16000 Calls today & am willing to pick up some limited positions for 15 pts but did not get filled. I had my eyes on the Jun 16500 calls too but then again, it might be too early to enter any positions there, plus the premiums weren't high enough to take the additional risk. I like to observe the markets to see how it pans out in the next few days. The Apr 9250 puts still look attractive for a 1 month play. I might just enter more but limited positions if the rally cannot sustain & resume its bearish trend. Mar's options will expire this Thu freeing up capital for additional May's income set ups.

Tuesday, March 11, 2008

Mar 11 Option Trades Update

Thursday, March 6, 2008

Mar 7 Option Trades Update

Japan stocks slide over 3% today. I wrote additional N225 Apr 9250 Puts for 30 pts.

Monday, March 3, 2008

Mar 4 Option Trades Update

Sunday, March 2, 2008

Mar 03 Option Trades Update

Asian markets tumbled Monday as investors reacted nervously to a steep decline on Wall Street Friday after disappointing economic and corporate news reawakened worries about a U.S. recession. The Nikkei shedded a whopping 610 pts (4.5%). I wrote limited new positions for N225 Apr 9250 Puts for a premium of 25 pts.

Subscribe to:

Posts (Atom)